CONCEPT OF ELASTICITY OF DEMAND

The elasticity of demand is the responsiveness of a dependent variable (demand) to a given change in an independent variable (price of a commodity, income of the consumer or prices of a commodity other than the commodity in question). An elasticity measures the sensitivity of one variable to another. Elasticity is therefore worked out in terms of a percentage or proportionate change in the dependent variable to a given percentage or proportionate change in the independent variable.

Corresponding to the three important determinants of demand we can talk about three important concepts of elasticity of demand. They are (i) Price elasticity of demand, (ii) Income elasticity of demand, and (iii) Cross elasticity of demand.

Price Elasticity of Demand

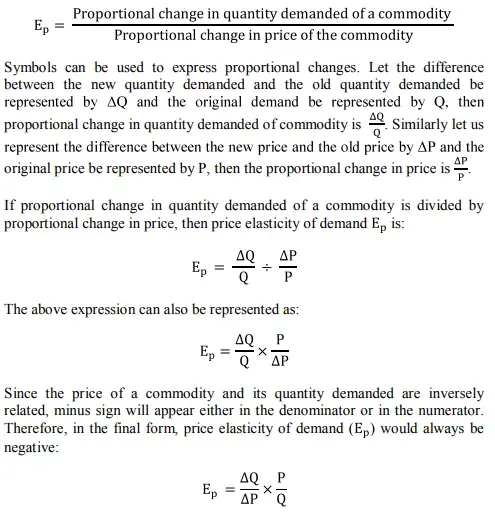

Price elasticity of demand is a measure of responsiveness of quantity demanded of a commodity to a change in the price of the commodity. This can be measured as the proportional (or percentage change) change in quantity demanded of a commodity divided by the proportional or percentage change in the price of the commodity. The result is called the price elasticity coefficient of demand. It can be estimated as follows: Let price elasticity coefficient be represented by Ep where P stands for price and E for elasticity of demand. Then

Interpretation of price elasticity coefficient

The value of may vary from Zero to infinity. For sake of convenience we can classify these in following five groups.

1) Ep = 0. This happens when the quantify demanded does not change at all with a change in the price of the commodity. This situation is called perfectly inelastic demand. Graphically it can be represented in the form of a vertical straight line demand curve as shown in Fig. . This would be seen that the quantity demanded of commodity remains unchanged at OQ, irrespective of the change in the price of the commodity.

2) Ep greater than zero but less than one – ( Ep > 0 < 1). This value is obtained when the percentage change in quantity demanded is less than the percentage change in price. For example, a 10 per cent fall in price may induce 8 per cent rise in quantity demanded. This type of demand is known as less than unit elastic.

3) equal to one ( Ep = 1). This value is obtained when the percentage change in quantity demanded equals the percentage change in price. A 10 per cent fall in price induces a 10 per cent increase in quantity demanded. This type of demand is said to be equal to unit elastic.

4) Ep more than one (Ep > 1). This type of elasticity of demand is obtained when the percentage change in quantity demanded is more than the percentage change in the price of a commodity. For example, a 10 per cent reduction in the price of quality chocolate may result in a 30 per cent increase in the quantity demanded of chocolates. In this case, Ep = 30%/10% = 3 . This type of demand is called more than unit elastic demand.

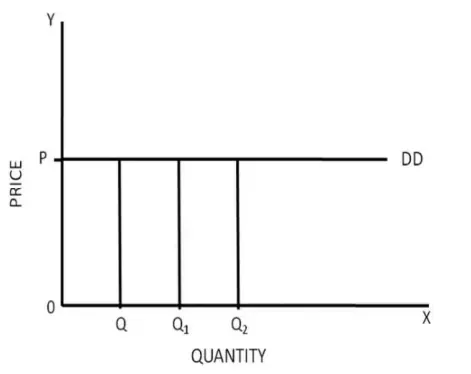

5) Ep equal to infinity. This type of elasticity of demand obtains when a small change in price results in infinite changes in quantity demanded. Alternatively, it can be represented as a situation in which it is not possible to determine the quantity that would be demanded at a given price. This type of demand is also called perfectly elastic demand. Perfectly elastic demand can be represented graphically with the help of a horizontal straight line, as shown in Fig.

Income Elasticity of Demand

Income elasticity of demand refers to percentage change in the quantity demanded resulting from percentage increase in income. In other words income elasticity of demand is the responsiveness of quantity demanded of a commodity to a change in income of the consumer. It can be measured as the proportional (or percentage) change in quantity demanded of a commodity divided by the proportional change in income of the consumer. The resultant coefficient is called the income elasticity coefficient. Let us use symbols to represent income elasticity of demand (Ei) where i stands for income and E for elasticity of demand. Thus, Ei is:

Where is the change in income of the consumer, Y is the original income, is the change in quantity demanded of a commodity and Q is the original demand. Income elasticity coefficient may have a positive value (>0) or a negative value (<0). The plus and minus sign along with assume great significance. If we are told that:

i) Ei = +1.8, we can assume that the commodity in question is a normal good.

ii) Ei = –1.8, we can assume that the commodity in question is an inferior good.

iii) Ei = 0, we can assume that there is no relationship between the income of the consumer and the quantity demanded of the commodity (.. Bare necessities of life).

Price Cross-Elasticity of Demand

Price cross-elasticity of demand refers to percentage change in the quantity demanded of one good resulting from some per cent increase in the price of another. In other words, the cross-elasticity of demand is the responsiveness of quantity demanded of the given commodity to a change in the price of a related good (it may be a substitute or a complementary good). It can be measured as proportional or percentage change in the quantity demanded of a commodity

Subscribe on YouTube - NotesWorld

For PDF copy of Solved Assignment

Any University Assignment Solution

.webp)